1.WARRANTY

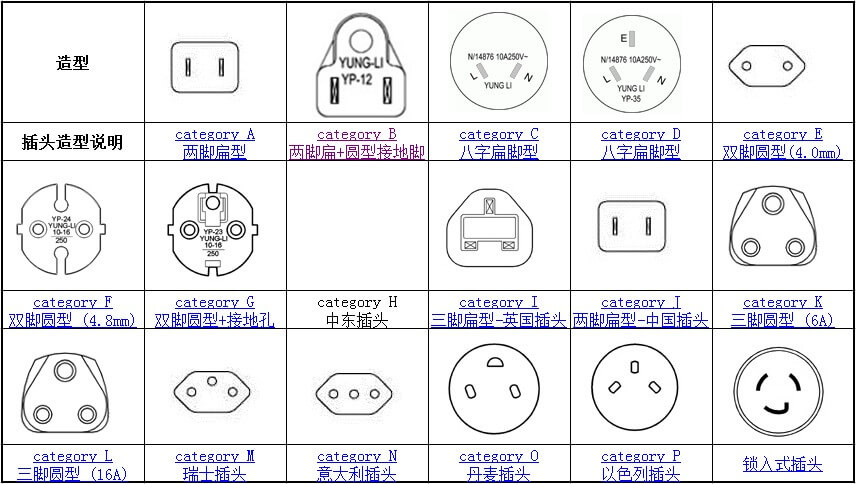

1.1 Please kindly tell us which your country’s voltage is and plug type before purchase.

1.2 After received instrument please keep the “factory serial number”this is important for after service.so far the chinese instrument is too cheap,can not afford over sea Maintenance Center.

the machine appear problems, you can check our website to find the "fixing" we ‘ll ask our tech section cover the problems including (trouble shooting guide,photo,video)if this method can not make sense,we will send you spare parts by fast express to your door(parts is free,freight cost usually still at buyer side.)

1.4 it can back to CHINA ,declare "no value" "normal items" .after it fixed or replaced.we can send to buyer again.

1.5 We promise life long service,if the instruments exceed the warranty period,we will also give advice and good service,but it will charge money for extra spare parts.

2.PLEASE KINDLY TELL US WHICH YOUR COUNTRY S VOLTAGE IS AND PLUG TYPE BEFORE PURCHASE.

3.PAY METHOD A:BANK WIRE TRANSFER=TT

This is most popular, easy and high efficient payment method in the world. It is Suits for the regular customer and distributor. And it is better to build mutual trust for us.

Atter buyer choose the model and confirm the price and other terms. firstly we need issue profoma invoice with buyers delivery information: street,city,province (state)county,international zip code.consignee name,telephone.

after you received profoma invoice with our order with bank information.

when payment arrived, we send out by fast express ,airlines ,ship at once to your home. you just keep your invocie when your order is arrive your nearest customs of your country, Forwarder contact you to make tax for your customs.( usually 20% of the invocie amount) ,

\this tax is collect by your country's customs .

as a favor,We can undervalue the invocie.but not too low.so you can save a lot of import tax.

4.SHANGHAI TOP VIEW PAYMENT ACCOUNT

You can make payment to our company account. we have register on FDA .this is USA 's highest medical instruments quality standard. Please link the below and see our company's registration information.

https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfRL/rl.cfm?rid=228201

Please noted: we only have below official payment method. if you have receive other payment account.please contact us at once!!!!!!! Don't be cheated!!!!

shanghai top view company account:

1.Shanghai Top View Industrial Co.,Ltd

(bank of CHINA)

2. SHTOPVIEW LIMITED

NANYANG COMMERCIAL BANK(CHINA)LTD

3.chinese RMB account:上官涛

5.HOW TO OPERATE IF SHIPPING BY SEA

Dear All,

As I deal with a lot of clients importing for the first time, I often see the same questions asked. These are things that perhaps we within the industry take for granted so I thought I would summarise the process from A to B to make it as clear as possible.

Lets assume that your order is ready at the factory and for arguments sake it is of a size suitable for shipping by seafreight - say a part load shipment (LCL) which is perhaps the most common.

1) Ask your supplier for an FOB price - This means they will arrange to get goods to the port of export and will almost certainly be the cheapest option in the long run.

2) Get a quote from a UK based freight forwarder such as ourselves at Woodland Global from FOB Port to delivered door UK. This will ensure no unexpected costs.

3) Should price be acceptable, confirm the booking with the freight forwader. You need to advise them that you accept the quote, provide confirmation of weight, cube and number of packages, type of goods. Give them contact details for your supplier including name and address, contact number/email and contact name along with any references required.

4) Ask the forwarder for details of their agent/office at the relevant place of origin.

5) You also need to decide at this point whether you want the goods insured - Ask for a price for this and again confirm in writing that you require this if acceptable.

6) Provide the supplier with the forwarders agents details and tell them that they will be in touch.

7) At this point behind the scenes the UK forwarder will get in touch with their overseas office, who in turn will make contact with the supplier. Once you have paid your supplier they will deliver goods in to the forwarders warehouse at the port of origin.

8) Goods will be loaded into a container, put on a Vessel and will be on their way.

9) A bill of lading is issued by the overseas agent, which shows the confirmed shipping details. This is a very important document as the 'holder' of the original bill of lading has legal title to the goods. There are two choices here that you and the supplier have that you need to agree between yourselves.

a) Have the original bill of lading sent to you in the UK. The overseas agent will issue the originals - (usually three of them) to the supplier. The supplier (once all costs have been paid to them) will post these to you. You will need to present one of the originals to the UK forwarder for them to release/deliver goods to you.

b) Ask your supplier for a telex release/express release. This simply means that the supplier will inform the agent that they do not require the originals as they have been paid. In this case you will not need to present the originals to the UK forwarder but you should still ask for a copy as it shows the shipment information.

10) So now the goods are on the water you need to consider getting them to you. Whether you are VAT registered or not, you will need to apply for an EORI number form HMRC, which effectively allows you to import. You need to complete a fairly simple application form that can be downloaded from HMRC website. It will ask for you and your trading details and details of the shipment n question. The form can be emailed to the EORI team at HMRC and they will process and issue this within 48-72 hours. I would recommend doing this a week or two before goods due into the UK. Please note you can only reclaim import VAT as input tax if you are VAT registered - An EORI alone will not allow you to do this.

11) You may receive a notice of arrival from the freight forwarder a week or so before the goods due into the UK, confirming the arrival details and often asking for your information for customs clearance. Please note that it is not a legal obligation to send out notice of arrivals so you should not rely on this alone - if you know goods are due in imminently call your forwarder and ask for an update.

12) Provide them with your EORI number, the commercial invoice, the original bill of lading (if required) and the customs tariff code for the goods. The tariff code is a ten digit number that refers to the exact product you are importing and will show what Duty rate you are to pay on the goods. The forwarder will often be able to suggest the right one for you but it is your legal responsibility to ensure this is correct - I would always recommend ringing the HMRC classification department who will provide this over the phone

13) Back to 'behind the scenes' now. The Vessel has arrived, the container has been unloaded and more than often the forwarder will move this to their customs warehouse to unload and carry out customs clearance.

14) The forwarder should then issue you with a sales invoice covering the shipping costs as quoted (Check it matches the quote - if it doesn't, ask why). You will also get a Duty/VAT invoice for those costs which the forwarder will have paid to HMRC. Here you might see a cost you were not expecting called a 'Deferment Fee'. This will usually be something like 15 minimum or 1.5% of total Duty/VAT. The reason you might not have been quoted this is that you do have the option of paying HMRC direct, although its usually easier to let the forwarder handle it and given the time constraints often a CHAPS is required which can cost more than the deferment fee.

15) Pay the forwarder. Credit arrangements are rare nowadays unless you are a very established importer so you will need to pay the invoices before they will book delivery. Payment methods vary but usually BACS/CHAPS or internet bank transfer are the most common methods.

16) Rent charges - This is something you need not worry about as long as you do everything in time. You will usually be given seven days free of charge from the date the container was unloaded (called the devan date) to get goods delivered to you. After this date you will incur daily rent costs, hence the need to be slightly on the ball and not delaying payment, etc.

17) Confirm delivery. Check payment has been received (don't wait for them to contact you if you know payment has been sent and received as they may handle thousands of transactions a day and they can get lost in the system) and ask when you can have delivery. Depending on location this might be next day or 2/3 days afterwards. The forwarder will usually only be able to give you a rough indication of when it might arrive (i.e. late AM) but you can usually request an AM/PM or timed delivery for a small additional cost.

18) Unloading. You will need to unload goods from the vehicle as the drivers are not insured to do this for you. Bear in mind factors such as restricted access and restricted parking and be sure to warn the forwarder of these in advance. If it is a large/heavy load, you may need to consider the need for a forklift.

I hope this guide covers most points you might encounter.

- Optometry Instruments

-

Ophthalmic Medical

- Fundus Camera

- Slit lamp

- lens &Adaptor&Beam Splitter

- Portable Slit Lamp

- Tonometer

- Retinoscope Ophthalmoscope

- Perimeter

- Operation Microscope

- Corneal Topographer

- Ophthalmic Ultrasound

- OCT & Laser

- Synoptophore

- Biological microscope

- UBM

- Phaco Emulsifier

- Contrast Sensitivity Function Tester

- Potential Acuity Meter

- Eye Surgical Instrument

- Visual Electrophysiology

- Fundus Camera

- glasses display

- Optician Machine

-

Vein Finder

- Glasses accessories & tools